Stocks have done so well this year that it’s fair to say market participants haven’t feared much. But just because risks haven’t affected markets lately doesn’t mean they won’t in the future. In that “spirit,” as Halloween approaches, we discuss what scares us about the economy and financial markets.

#1: Stalwart Upper-Income Consumers Are Starting to Feel Some Pressure

For U.S. consumers, it’s the best of times and the worst of times. It’s no surprise that upper-income households supported consumer spending in recent periods. And it’s also no surprise that firms like credit card lender Capital One (COF) want to focus on the wealthier consumer, knowing those consumers weather downturns better.

When people talk about a “resilient consumer,” what they are really talking about is upper-income households. To borrow from Charles Dickens, the current macro landscape is the best of times and simultaneously the worst of times.

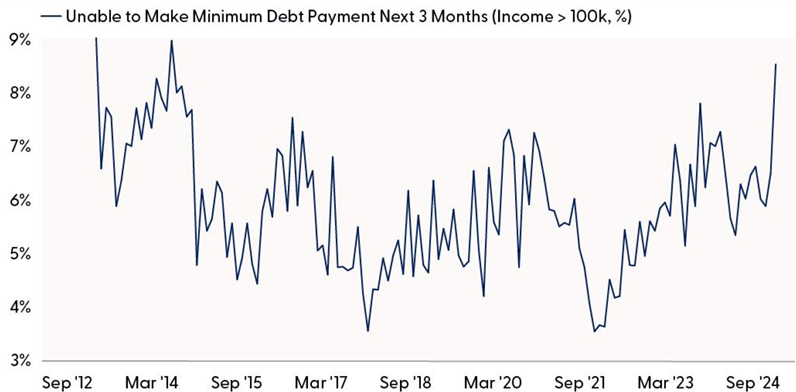

So, it behooves investors to carefully track the health of wealthier consumers, and they just got a troubling update from the New York Federal Reserve (Fed). What scares us this Halloween season is the potential stress on the wealthier cohort as more upper-income households reported they will most likely be unable to make their minimum debt payment — now at the highest percentage since mid-2014 when the economy was feeling the aftereffects of the Global Financial Crisis.

Upper-Income Households Are Under Some Pressure

Source: LPL Research, Federal Reserve Bank of New York 10/24/24

Wealthier consumers are likely supporting the business environment because they are the ones feeling the benefits from rising investment portfolios, higher home equity, and solid income growth. The wealth effect — the behavioral impact on consumers when they feel richer — is still strong, but we may be starting to notice the beginnings of stress. At the same time, consumer loan delinquencies are broadly rising, suggesting the economy is poised to slow, which may lead to increased market volatility in the months ahead.

#2: Mountain of Federal Debt Is Getting Larger and More Costly With No End in Sight

Fixed income investors tend to be rather nervous by nature, so coming up with things that scare a bond strategist could fill a series of weekly commentaries. From a potential reacceleration of inflationary pressures under a “no-landing” scenario to credit spreads widening due to a pick-up in corporate defaults, there are usually a myriad of things that concern fixed income markets.

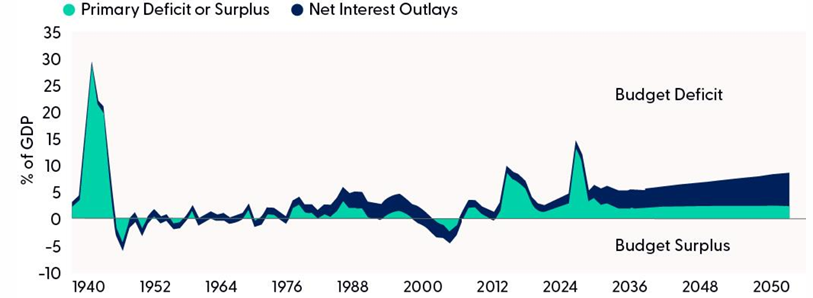

But while these risks could create cyclical challenges, the larger and more enduring risk to fixed income markets remains the amount of Treasury debt needed to fill massive federal budget deficits. Regardless of who ultimately becomes our 47th president (or the makeup of Congress), the biggest loser could be the fiscal deficit. Per the Congressional Budget Office (CBO), the U.S. government is expected to run sizable deficits over the next decade — to the tune of 5%-7% of gross domestic product (GDP) each year. The deficit is on track to increase significantly in relation to GDP over the next 30 years, reaching 8.5% of GDP in 2054.

That growth results from rising interest costs as well as large and sustained primary deficits. The CBO’s deficit projections likely underestimate future budget deficits because they assume no new spending initiatives, nor do they incorporate an extension of the Tax Cuts and Jobs Act from 2017, which is set to sunset at the end of 2025. To fill those deficits, the Treasury Department will need to issue trillions more in Treasury securities.

Federal Interest Payments Set To Dominate Federal Outlays

Source: LPL Research, Congressional Budget Office 10/24/2024

Disclosure: Estimates may not materialize as predicted and are subject to change.

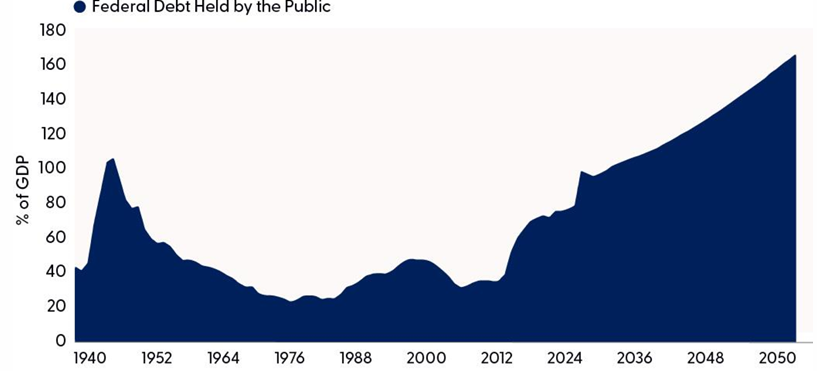

In early October, total outstanding Treasury debt eclipsed $35 trillion, which is up from the $31.5 trillion in June 2023, right before Congress gave the Treasury Department unfettered borrowing capacity until January 2025. Now, to be fair, only around $28 trillion of that is held by the public (with the rest held within the U.S. government). Framed against economic growth (GDP), total debt held by the public is currently a manageable 99% of GDP. Debt held by the public, boosted by large deficits, is expected to eclipse its highest level ever in 2029 (measured as a percentage of GDP) and then continue to grow, reaching 166% of GDP in 2054 and remaining on track to increase thereafter.

Federal Debt Held by Public Expected To Explode Higher

Source: LPL Research, Congressional Budget Office 10/24/2024

Disclosure: Estimates may not materialize as predicted and are subject to change.

Despite the mountain of debt and growing interest payments, the U.S. government is not at risk of financial collapse, nor are there concerns as such. There will always be buyers of Treasuries. However, regardless of leadership in Washington, the deficit will stay high for years to come and it will probably take market volatility for politicians to take the deficit seriously, similar to what took place in the U.K. in 2022 or France in 2024. That creates downside risk for the economy and investment portfolios.

#3: Stock Valuations Are Rich

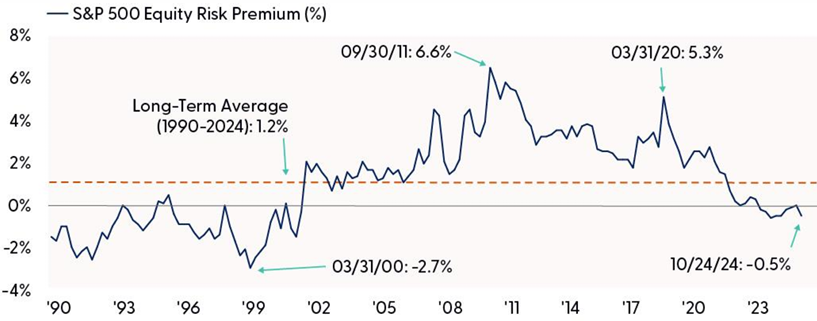

It’s not a hot take to point out that stock valuations are on the high side. On a simple price-to-earnings ratio (P/E) basis using estimated next four quarters’ earnings per share, the S&P 500 is currently selling for 21.8 times. That compares to the 20-year average at 16. Even using the higher, more recent valuation levels, the five-year average is 19.8. Clearly valuations are high, though they are not great timing tools for tactical trading

Stocks are still overvalued even when factoring in interest rates. The accompanying chart, which compares stock valuations to Treasury yields (specifically, earnings yields vs. Treasury yields), illustrates that stock valuations appear expensive even with factoring in interest rates that are actually below long-term historical averages. The 10-year Treasury yield never dipped below 4% in the 1980s or 1990s, and it averaged 4.44% from 2000 through 2009.

Latest Move Higher in Treasury Yields Makes Stock Valuations Even More Elevated

Equity Investors Are Not Being Compensated for Taking On Equity Risk

Source: LPL Research, FactSet 10/24/2024

Disclosures: All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results. Estimates may not materialize as predicted and are subject to change.

High valuations are worrisome because once the economy and corporate profits deteriorate, for whatever reason, market declines will be larger if valuations are higher. Further, studies show that long-term stock returns — say five to 10 years out — tend to be more modest if the starting point for valuations is high. (Goldman Sachs recently wrote about this, forecasting a 3% return over the next 10 years.) We’ll leave that debate for another day, though we do think that forecast is too low given potential productivity gains. The scary point here is that the more a market inflates during good times, the bigger downside moves tend to be once the good times end.

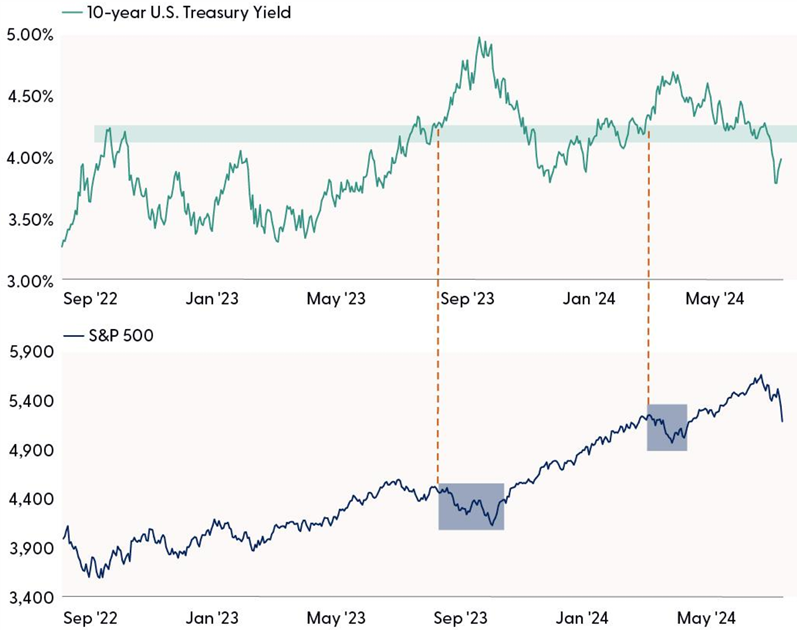

#4: Interest Rates Are Breaking Out to the Upside

LPL Research expects 10-year Treasury yields to remain range-bound between 3.75%-4.25% over the coming months. However, that doesn’t mean a surge in rates is off the table, especially amid improving economic data and a recent uptick in inflation expectations. Higher rates can hurt the economy, the equity market, and bond prices. Higher borrowing costs impair demand for big-ticket purchases. Higher yields tend to weigh on stock valuations and increase the cost of capital, especially for the more debt-laden small cap space. And, of course, higher rates drag down bond values (though the return prospects of future bond investments are lifted by those higher yields).

Recent technical developments in Treasuries point to rising upside risk for rates. Benchmark 10-year yields have bounced off oversold levels and reversed a downtrend dating back to the April highs. Momentum indicators have turned bullish, but yields will need to clear key resistance at 4.3% (October 2022 highs) for the advance to continue. And while the velocity of rising rates often dictates the damage to stocks, we believe a breakout above this resistance level could be a tipping point for risk appetite. As highlighted in the bottom panel of the chart below, the last two sustained moves above 4.3% created headwinds for equity markets. The start of the S&P 500 correction last fall and its pullback this spring both overlapped with a breakout in yields above this key area of overhead resistance.

Stocks Have Had Trouble With Treasury Yields Above 4.3%

Source: LPL Research, Bloomberg 10/24/24

Disclosures: All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

#5: Policy Uncertainty and Political Divisiveness

With Election Day only six trading days away, policy uncertainty ahead of the election may not cause a stock market correction. If one occurs in the coming weeks, it could be related to concerns about tax increases in 2026, when the Trump tax cuts sunset. This risk is known and far off but could still cause market volatility.

Also consider the possibility of another disputed outcome, a very long way for results, and/or intensifying political divisiveness as risks to investor sentiment. Having gone through the “hanging chads” of the Bush vs. Gore election in 2000, various swing state recounts, and the January 6 experience in 2021, perhaps markets are battle-tested for election chaos. We can also take some comfort in history’s lesson that stocks tend to rally after elections, regardless of the outcome. But as the country gets more divided, investors’ moods could be negatively impacted and weigh on stock valuations.

#6: Geopolitical Threats

The unfortunate truth is the list of geopolitical threats is long and serious. The conflict in the Middle East could expand as well as lead to more lost lives and higher oil prices. The Russia-Ukraine war is tragically more than two years old, and North Korea is sending troops to help Putin. Tariffs may be broadened or increased on China regardless of the outcome of the November election. The trend toward “de globalization” is disruptive and inflationary. There’s plenty to worry about.

At the top of the list of what could disrupt the U.S. economy and markets near term, we would put the possibility that China moves aggressively to take control of Taiwan, a key producer of semiconductors globally. This risk is evident in Taiwan Semiconductor’s (TSM) recent emphasis on its strategic plans for expansion beyond Taiwan as concerns regarding Beijing’s plans for incorporating Taiwan into its “one nation” policy — by force if necessary — continue to add to a rising global risk profile.

The latest news is regarding the efficacy of the “production yields” at TSM’s Arizona-based manufacturing facility, which was due to begin operating this year but because of delays in attracting and training workers is now likely coming in 2025. In fact, chip production from the Arizona fab is 4% higher than its Taiwan based headquarters, which should help placate worries that the delay is also hurting production quality and yield. The positive results, which come from a study within the Arizona plant, fit in with a now-ongoing series of upbeat announcements from TSM’s headquarters that progress is being made in offshoring operations beyond Taiwan.

Conclusion

As Halloween approaches, there are several risks that scare us and may lead to increased market volatility in the months and years ahead. But these risks don’t prevent us from recommending investors to stay fully invested at their targets for both equities and fixed income. We’re still in a bull market with a growing economy, rising corporate profits, and a favorable technical analysis picture. Valuations are elevated but are not good timing tools. And while the deficit is worrisome, the timing of when it will become enough of a concern to drive sustained weakness for stocks or bonds is uncertain. Finally, policy uncertainty and political divisiveness may lead to higher volatility, but history tells us that those episodes tend to be short-lived. The resilience of the U.S. economy and corporate America will win in the end.

Asset Allocation Insights

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities. High valuations introduce risk if earnings don’t come through, but market momentum remains strong and seems to be telling us earnings will deliver. That said, the Committee acknowledges the potential for short-term weakness, especially as geopolitical threats in the Middle East escalate and the U.S. presidential election quickly approaches. Equities must also readjust to what we expect will be a slower and shallower Fed rate-cutting cycle than markets are currently pricing in, although both post-election seasonality has historically been favorable for stocks.

Tactically, the Committee maintains a slight preference for growth over value, recommends keeping allocations across market caps generally in line with benchmarks, favors U.S. equities over their international and emerging markets counterparts, and recommends an up-in-quality approach to fixed income, with a small allocation to preferred securities for appropriate investors due to still-attractive valuations.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All investing involves risk, including possible loss of principal.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from Bloomberg.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

For public use.

Member FINRA/SIPC.

RES-0001985-0924W Tracking #650084 (Exp. 10/25)