At LPL Research, as we look forward to the year 2020 and a new decade, some key trends and market signals will be important to watch, including progress on U.S.-China trade discussions, an encouraging outlook from corporate America, and continued strength in consumer spending.

Trade risk, slower global growth, and the impeachment inquiry have garnered a lot of the headlines recently, but behind the scenes the U.S. economy has remained resilient. Economic data has been meeting lowered expectations, indicating an expansion that is still enduring. Most recently, third quarter economic growth was consistent with the long-term trend of this current economic expansion, which is now more than 10 years old.

Trade risk, slower global growth, and the impeachment inquiry have garnered a lot of the headlines recently, but behind the scenes the U.S. economy has remained resilient. Economic data has been meeting lowered expectations, indicating an expansion that is still enduring. Most recently, third quarter economic growth was consistent with the long-term trend of this current economic expansion, which is now more than 10 years old.

Economy

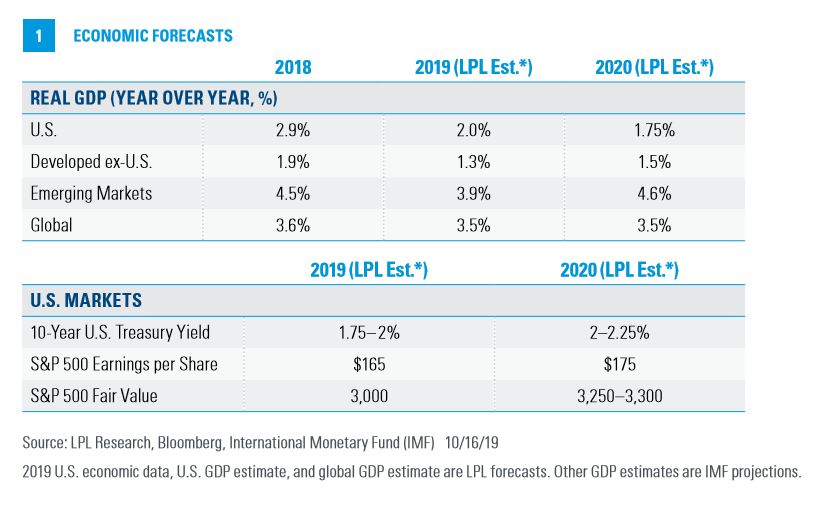

Domestic: We are expecting 1.75% U.S. GDP growth in 2020. Our forecast reflects the potential for continued trade uncertainty and weak business investment, but a steady consumer [Figure 1].

Global: Europe and Japan continue to struggle with trade uncertainty, geopolitical concerns, and sluggish growth. We anticipate more opportunities for growth in emerging markets’ economies, with countries outside China playing a growing role.

Inflation: Consumer inflation has picked up slightly, and we believe inflation will continue to grow at a healthy but manageable rate. Employment: U.S. job growth has been steady, although recently it has started to show signs of moderating. Some cooling down would be expected at this point in the economic cycle.

Recession: Prolonged trade uncertainty and a potentially rancorous U.S. election season lead us to believe that recession starting in the fourth quarter of 2020 or first quarter of 2021 could be possible, but we don’t think it’s probable.

Bonds

Short-lived and shallow yield curve inversions are not worrisome in our view, and we continue to emphasize a blend of high-quality intermediate bonds in tactically oriented portfolios.

Stocks

We look for solid U.S. equities performance to continue, and we see more potential upside in emerging markets than developed international markets. We continue to prefer cyclical sectors for appropriate strategies as the U.S. economic expansion endures, and a balance of growth and value styles.

Click here to download a PDF of this report.

The opinions, statements, and forecasts presented herein are general information only and are not intended to provide specific investment advice or recommendations for any individual. It does not take into account the specific investment objectives, tax and financial condition, or particular needs of any specific person. There is no assurance that the strategies or techniques discussed are suitable for all investors or will be successful. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Any forward-looking statements including the economic forecasts herein may not develop as predicted and are subject to change based on future market and other conditions. All performance referenced is historical and is no guarantee of future results.

References to ‘Markets,’ ‘Sectors,’ and ‘Stocks’ herein are generally regarding the index tracking the corresponding asset class. All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL is not an affiliate of and makes no representation with respect to such entity.

If your advisor is located at a bank or credit union, please note that the bank/credit union is not registered as a broker-dealer or investment advisor. Registered representatives of LPL may also be employees of the bank/credit union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, the bank/credit union. Securities and insurance offered through LPL or its affiliates are:

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

Tracking #1-922801 (Exp. 12/20)