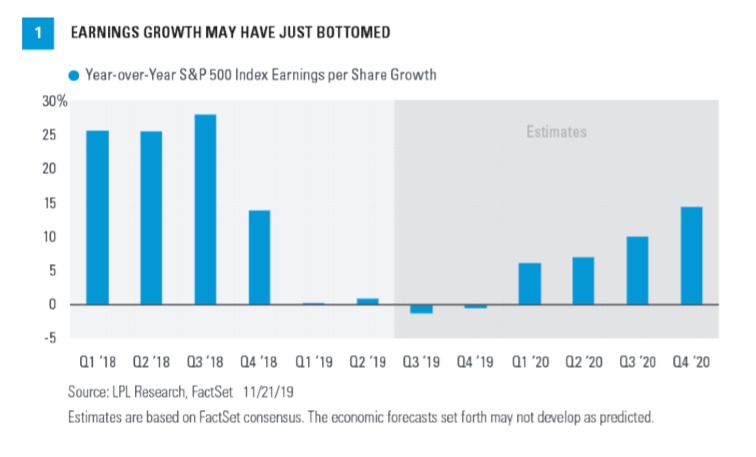

While earnings declined year over year in the third quarter, results still exceeded expectations. Tariffs, ongoing policy uncertainty, and slower global growth have led to this earnings lull, but we remain optimistic that earnings growth bottomed last quarter and is poised to accelerate.

RECAP OF THIRD QUARTER EARNINGS

As expected, corporate America delivered little in the way of earnings growth in the third quarter. S&P 500 Index earnings fell around 2% year over year, about 2 percentage points above October 1 estimates (source: FactSet). That doesn’t sound great, but given the economic headwinds, the result was better than some had expected. In addition to tariffs and trade uncertainty, those earnings headwinds in the third quarter included:

- Falling oil prices, which led to a sharp drop in energy sector earnings

- A rising U.S. dollar, which weighed on international earnings for multi-national U.S. companies

- A 25% year-over-year decline in semiconductor industry earnings (partly related to the U.S.-China trade tensions)

- A challenging interest rate environment that curbed financial sector earnings

POSSIBLE EARNINGS TROUGH

Although the quarterly earnings growth rate was hardly worth getting excited about, we think the third quarter may have marked a trough in earnings growth for several reasons [Figure 1].

In reviewing third quarter earnings reports, we also noted a few other key takeaways.

Corporate executives’ commentary may reflect ebbing trade tensions. Of the first 451 S&P 500 companies to report, just 113 cited tariffs on their earnings conference calls, according to FactSet data. This is a 13% decline from the prior quarter’s total (and 25% below third quarter 2018). This may reflect improving prospects for a U.S.-China “phase one” deal.

Guidance has been encouraging. Estimates for future quarters almost always drop during earnings season, and this most recent quarter was no exception. However, the 1.7% reduction in estimates for the next four quarters was smaller than average, and encouraging given the headwinds.

Healthcare a standout performer. Revenues for the healthcare sector grew 15%, the best of the 11 S&P 500 sectors. Healthcare sector profits rose 9%, trailing only utilities. In addition, the sector produced among the biggest upside surprises on both the top and bottom lines. Healthcare companies have benefited from increased healthcare spending related to demographic trends as populations in the United States, Europe and Japan age. Healthcare companies also are relatively insulated from the U.S.-China trade conflict.

Profit margins have held up. The S&P 500’s operating margin last quarter was just 0.5% below a record high set in the fourth quarter of 2014 and matched in the first quarter of 2019 (source: FactSet). This showed that rising wage and other cost pressures have yet to significantly impede earnings.

Solid revenue growth. S&P 500 companies’ revenue grew at a better-than-expected 3.1% year-over-year pace in the quarter. Nominal gross domestic product (GDP), which includes inflation, grew 3.7% year-overyear in the third quarter. This pace of economic growth usually has provided a solid foundation for future revenue, as nominal GDP and revenues historically have been closely correlated. A steady flow of share repurchases, which boost earnings per share (EPS) by reducing share counts, has set the stage for potential mid-single-digit earnings growth without any increase in profit margins.

A LOOK AHEAD

We expect S&P 500 earnings to grow to $175 per share at the end of 2020, which would be about 6% higher than our $165 per share forecast for 2019. Our year-end 2020 EPS forecast is roughly $4 below the current consensus (Source: FactSet). We see support for 2020 EPS growth from:

- Steady economic growth. We expect GDP growth near average for the economic expansion and manageable inflation that may support revenue growth in the 3% to 4% range.

- Interest rates should normalize, in our view, which could potentially support better financial sector profits.

- Progress on trade may lead to a resurgence in capital investment, which could lift earnings growth, especially for industrial and technology companies.

- Manufacturing rebound. Leading indicators of global economic activity have stabilized, which we see as indicating a potential pickup in U.S. manufacturing activity.

- Share repurchases will likely continue to boost EPS by decreasing the share count.

TRADE RISK REMAINS

The U.S.-China trade conflict remains a wildcard, and we’re unlikely to see a “clean” resolution anytime soon. In the absence of any progress on trade, earnings would likely stagnate near current levels, and there would be downside risk to our 2020 forecast.

Any small steps forward on trade could increase business confidence and spark capital investment, both tailwinds for corporate profits. We expect the tariffs threatened for December 15—impacting many consumer goods—to be removed as part of a potential “phase one” deal with China. There’s also a possibility the tariffs implemented in September could be reduced, although that has been a key sticking point in the negotiations to date.

ARE STOCKS AHEAD OF THEMSELVES?

Some investors may think stocks have gotten ahead of themselves with the S&P 500 near all-time highs. We believe that earnings growth prospects for 2020, mild inflation, and low interest rates, are sufficient to support stocks at current valuations. Our $175 S&P 500 EPS forecast coupled with a price-to-earnings ratio (P/E) around 18 puts the index near 3,200 at the end of 2020. A favorable outcome on trade could potentially justify higher valuations and support higher S&P 500 levels.

Look for our LPL Research Outlook 2020: Bringing Markets into Focus publication the first week of December for more details on our forecasts.

WEEKLY MARKET PERFORMANCE REPORT

We are pleased to share our new Weekly Market Performance report with insights on major asset classes.

Click here to download a PDF of this report.

IMPORTANT DISCLOSURES

The opinions and forecasts voiced in this material are for general information only and are not intended to provide specific financial advice or recommendations for any individual. The economic forecasts are subject to change and may not develop as predicted. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

DEFINITIONS

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

INDEX DESCRIPTIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

This research material has been prepared by LPL Financial LLC. Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL is not an affiliate of and makes no representation with respect to such entity.

If your advisor is located at a bank or credit union, please note that the bank/credit union is not registered as a broker-dealer or investment advisor. Registered representatives of LPL may also be employees of the bank/credit union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, the bank/credit union. Securities and insurance offered through LPL or its affiliates are:

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

Tracking # 1-920225 (Exp. 11/20)