In corporate credit markets, early indicators of stress often emerge subtly — not through dramatic dislocations, but through nuanced shifts in borrower behavior and market dynamics. Much like canaries in coal mines once signaled invisible threats, and Jamie Dimon’s warning about “cockroaches” in credit markets hinted at more credit events to come, recent developments in the leveraged credit space suggest areas of vulnerability are worth monitoring. While investment-grade markets remain well-supported by strong technicals and steady demand, signs of strain among lower-rated issuers — including isolated defaults and rising payment-in-kind activity — point to a more complex backdrop. Moreover, given the rising idiosyncratic risks within markets, credit spreads and total yields in most corporate bond markets are still low, in our view, investors aren’t getting duly compensated for taking on a lot of credit risk in portfolios. The recent increase in credit risks does not imply an imminent or broader systemic crisis, but it underscores the importance of maintaining a disciplined, diversified approach as investors navigate a landscape shaped by higher rates, tighter lending standards, and evolving credit conditions.

From Strength to Stress: A Look at Credit Market Segments

Corporate credit markets represent a vital component of the global financial system, providing businesses with essential capital for operations, growth, and strategic initiatives. These markets can, in general, be segmented into four distinct categories: investment-grade bonds, high-yield bonds, bank loans, and private credit. The high yield, bank loan, and private credit markets can be grouped together, commonly referred to as leveraged credit markets. Each segment serves different borrower needs and offers investors varying risk-return profiles.

Investment-grade corporate bonds represent the highest-quality segment of public debt markets, with over $7 trillion outstanding in the United States alone. These securities are issued by companies with strong balance sheets and stable cash flows, earning credit ratings of BBB- or higher from agencies like Standard & Poor’s and Moody’s. Investment-grade issuers typically include established multinational corporations with proven track records.

High-yield bonds, often called “junk bonds,” occupy the riskier end of the public credit spectrum with a U.S. market size of approximately $1.5 trillion. Issued by companies rated BB+ or below, these securities compensate investors for elevated default risk with higher interest rates. High yield issuers may include younger companies, businesses undergoing restructuring, or firms operating in cyclical industries. While these bonds carry greater credit risk, they offer investors enhanced returns and portfolio diversification opportunities.

Bank loans, also known as leveraged loans or syndicated loans, represent approximately $1.4 trillion in outstanding value. These floating-rate instruments are typically arranged by banks and syndicated to institutional investors. Bank loans hold senior positions in a company’s capital structure, providing greater protection through collateral and covenant packages. Their floating-rate nature offers investors risk mitigation against rising interest rates, distinguishing them from fixed-rate bonds. Borrowers often include private equity-backed companies and firms with below-investment-grade credit profiles.

Private credit has emerged as the fastest-growing segment, with assets under management exceeding $1.5 trillion globally. This category encompasses direct lending arrangements between non-bank institutional investors and middle-market companies. Private credit transactions are bilaterally negotiated and not publicly traded, offering flexibility in structure and terms. This market typically features higher yields than comparable public markets, reflecting illiquidity premiums and the specialized expertise required. Private credit serves companies seeking customized financing solutions, faster execution, and greater confidentiality than public markets provide.

Each segment of the corporate credit market serves a distinct purpose within the broader financial ecosystem. Investment-grade bonds offer stability and liquidity, high-yield bonds provide access to capital for riskier credits; bank loans deliver secured floating-rate exposure; and private credit offers bespoke solutions for middle-market borrowers. Together, these markets create a comprehensive financing landscape worth over $11 trillion that accommodates the diverse needs of corporate borrowers while providing investors with a spectrum of risk-return opportunities.

Cracks Showing in the Leveraged Credit Markets?

To state the obvious, coal mining is a dangerous occupation. Not only do coal miners have to deal with collapsing tunnels and explosions, but they also must deal with the potential for dangerous carbon monoxide fumes. As crafty folks that (obviously) wanted to stay alive, coal miners would bring canaries with them into the mines to help sniff out the dangerous fumes. Canaries, apparently, are much more sensitive to the odorless fumes, so if miners saw the birds becoming distressed, it would serve as a warning sign that carbon monoxide fumes were likely prevalent, and they should reverse course.

Within fixed income markets, the corporate credit market can, at times, act like a canary in the economic coal mine. The return distribution for credit investors is asymmetrical, which means the potential for losses can be magnitudes larger than the potential for gains. So, credit markets tend to react quickly when economic conditions start to deteriorate.

Throughout the year, investment-grade corporate bonds have benefited from strong technicals. While spreads (or the additional compensation required to own riskier debt) remain at or near secular tights, total yields are still elevated, which has supported steady inflows into taxable bond funds and ETFs. Both foreign and institutional demand have also remained strong this year, which has helped keep spreads rangebound.

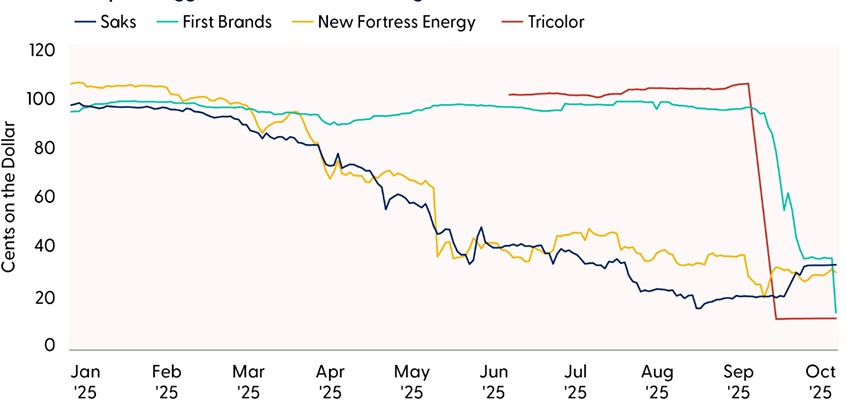

However, this strength masks a growing fragility in the broader credit landscape, particularly among lower-rated corporate borrowers. A series of recent collapses, including those of Saks, New Fortress Energy, Tricolor Holdings, and First Brands Group, have inflicted losses of 60% or more on investors, prompting worries that these kinds of events may not be one-offs. Jamie Dimon, CEO of J.P. Morgan Chase, recently noted that these types of credit events, while seemingly unrelated, are like cockroaches and “when you see one cockroach, there are probably more.” And perhaps presciently, his warning came days before a few regional banks disclosed loan fraud losses, putting downward pressure on both stock and bond prices (and upward pressure on bond yields). While seemingly unrelated to the regional banking crisis that took place in 2023, when Silicon Valley Bank (SVB) filed for bankruptcy protection after it lost a quarter of its deposits in a single day (it lost another 62% of deposits the following day before it was closed by regulators), fears remain elevated, particularly among regional lenders.

Recent Collapses Suggest Credit Risks Are Rising

Source: LPL Research, Bloomberg 10/17/25

Lines represent company bond prices. Par price is $100

Past performance is no guarantee of future results.

Moreover, according to Cornerstone Research, the first half of 2025 saw 17 “mega” bankruptcies — defined as filings by companies with over $1 billion in assets — the highest number for any six-month period since the COVID 19 pandemic. Total large-company filings (assets over $100 million) reached 117, marking an 81% increase over the long-term average. Through October 4, that number has continued to grow with 142 large bankruptcy filings this year compared with 133 during the same period last year. Years of high interest rates, which are good for investors but not so great for borrowers, are clearly weighing on some companies.

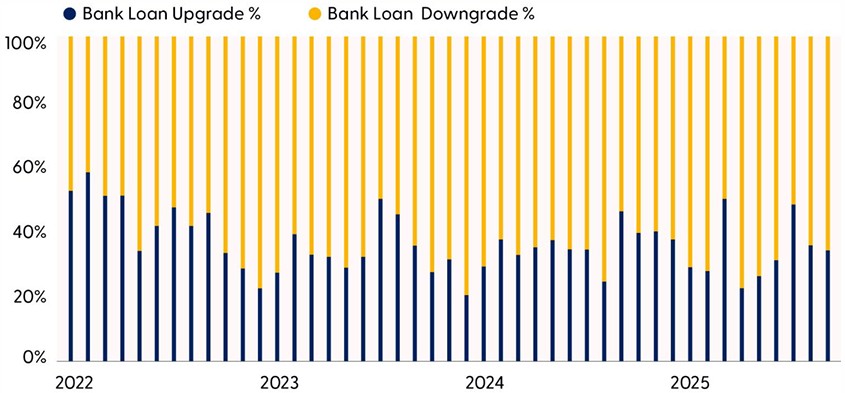

While the overall credit market remains stable, the divergence between investment-grade and leveraged credit is becoming increasingly pronounced. The recent uptick in defaults and distressed exchanges among speculative grade issuers underscores the vulnerability of companies with weaker balance sheets and limited access to capital. This bifurcation is not new, but it is becoming more acute in the current environment of elevated interest rates and tighter lending standards. Moreover, rating agencies have steadily downgraded more leveraged loan issuers this year than they’ve upgraded, which has historically portended an increase in defaults.

Sounding the Alarm?

Rating Agencies Are Downgrading More Bank Loan Issuers Than They’re Upgrading

Source: LPL Research, Bloomberg 10/17/25

Past performance is no guarantee of future results.

Additionally, the refinancing wall facing many lower-rated issuers in 2026 and 2027 could be a key stress point. Companies that issued debt during the ultra-low rate era are now confronting significantly higher costs to roll over their obligations. For those with limited cash flow or declining revenue, this could lead to a wave of restructurings or defaults, particularly if economic growth slows or credit conditions tighten further.

Private credit markets, which have grown substantially over the past decade, are also beginning to show signs of strain. As traditional banks have pulled back from riskier lending, private lenders have stepped in to fill the void — often with less transparency and looser covenants. While this has provided flexibility for borrowers, it has also introduced new risks for investors. The lack of public disclosure and standardized reporting makes it difficult to assess the true health of these portfolios, and any deterioration could be slow to surface.

But private credit markets continue to see strong inflows, albeit at a slower pace, as investor interest has moderated. So far, defaults remain low, with data from the Proskauer Private Credit Default Index indicating a default rate of only 1.76% during the second quarter of 2025. A slight decrease from the 2.67% figure at the end of 2024. While defaults remain low, we are watching the increase in payment-in-kind (PIK) interest. PIK interest allows borrowers to defer cash interest payments by issuing additional debt instead. While this may support borrowers facing short-term liquidity issues as a longer-term solution is developed, over 11% of investments today are using PIK financing, a four-year high. Interest rate coverage metrics (defined as adjusted EBITDA divided by total interest expense) are also at a multi-year low, with data from Houlihan Lokey indicating an average coverage ratio of 1.8X at the end of the second quarter, down from a peak of 3.51X in the third quarter of 2021. While the average borrower is still easily covering interest payments, there has been a significant increase in the number of borrowers who are just meeting their interest expenses. This stood at 11.2% at the end of Q2.

What Does This Mean for Investors?

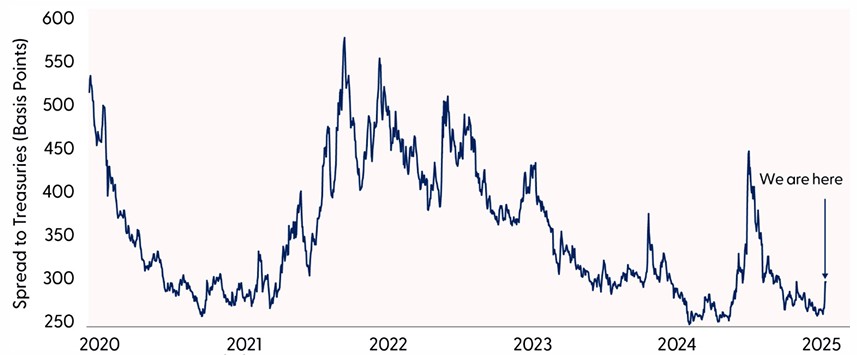

Now, the concern isn’t that we were on the verge of a crisis — at least not as long as the economy continues to grow as we expect — it’s more that investors aren’t getting paid to take on these types of risks with corporate bond yields that are barely above Treasury yields. Admittedly, over the last five years, higher borrowing costs have imposed greater discipline on lower quality issuers, leading to a clear downward shift in the market’s overall risk profile. But there will always be idiosyncratic risks within these markets, and market pricing should reflect those concerns. And while spreads for leveraged credit markets have moved wider in recent trading sessions, in our view, spreads are still too tight given current conditions and rising idiosyncratic risks. High yield spreads, while coming off recent tights, are still meaningfully below the widening that took place earlier this year after the so called “liberation day” pushed yields to 4.50% over Treasuries. At around 2.91% over Treasuries, high-yield spreads are only in the 12th percentile since 2001 — meaning since 2001, spreads have been higher roughly 88% of the time. Spreads and yields for the bank loan and private credit markets are also too low given rising idiosyncratic risks and slowing investment opportunities.

High-Yield Spreads Have Widened but Are Still Not Wide

Source: LPL Research, Bloomberg 10/17/25

Past performance is no guarantee of future results.

Bottom line, while corporate credit markets are not in crisis, the growing number of bankruptcies and signs of stress among lower-rated issuers suggest that cracks are indeed forming. Investors should remain vigilant, balancing the appeal of attractive yields with a clear-eyed view of the underlying risks. As always, diversification, discipline, and a long-term perspective will be key to weathering any turbulence that may lie ahead. Corporate credit markets are still well-priced in our view, so we don’t think investors are being appropriately compensated given current (and growing) risks. Securitized markets — residential mortgage-backed securities, asset-backed securities, and select commercial mortgage-backed securities — remain attractive, in our view.

On the private credit side, we remain constructive and also favor portfolios with flexible and broader mandates that can diversify their positions beyond direct lending and participate in unique opportunities, such as asset-based lending, distressed, or special situations. The asset-based lending sector is an area to watch going forward, as this category that includes loans, securitization, leasing, factoring, and other tangible-backed financial assets has been growing rapidly.

Asset Allocation Guidance

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities. Investors may be well served by bracing for occasional bouts of volatility given how much optimism is reflected in stock valuations, lingering tariff and inflation risks, and historical seasonal volatility in October. LPL Research advises against increasing portfolio risk beyond benchmark targets currently and continues to monitor trade negotiations, economic data, earnings, the bond market, and various technical indicators to identify a more attractive entry point to potentially add equities on weakness.

STAAC’s regional preferences across the U.S, developed international, and emerging markets (EM) are aligned with benchmarks. The Committee still favors growth over value, large caps over small caps, and the communication services and financials sectors.

Within fixed income, the STAAC holds a neutral weight in core bonds, with a slight preference for mortgage-backed securities (MBS) over investment-grade corporates. The Committee believes the risk-reward for core bond sectors (U.S. Treasury, agency MBS, investment-grade corporates) is more attractive than plus sectors. The Committee does not believe adding duration (interest rate sensitivity) at current levels is attractive and remains neutral relative to benchmarks.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All investing involves risk, including possible loss of principal.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

High yield/junk bonds (grade BB or below) are not investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Proskauer Private Credit Default Index is a quarterly index that tracks the default rates of senior-secured and uni-tranche loans in the United States. Developed by Proskauer Rose LLP, it defines a default as a payment, financial covenant, or bankruptcy default, and includes loans amended in anticipation of a default. The index provides a breakdown of default rates by company EBITDA (earnings before interest, taxes, depreciation, and amortization) and industry.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet or Bloomberg.

This research material has been prepared by LPL Financial LLC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

For public use.

Member FINRA/SIPC.

RES-0006007-0925 Tracking #813071 | #813072 (Exp. 10/26)